Union Payroll Management – Compliance and Special Considerations With Softwa

Running union payroll is a complex and time-consuming task. Getting it right is essential to ensure compliance with CBAs, labor laws and tax authorities.

Thorough and organized record-keeping is required for audits, compliance checks and resolving disputes. Construction software that automates payroll calculations and reporting can help reduce manual tasks.

Streamlined Reporting

Managing union payrolls requires more than just paycheck deductions. It requires a system that manages payroll items that don’t appear on the paycheck, such as union benefit calculations and labor cost allocation fees. It also needs to be able to create certified payroll reports like federal Form WH-347 and the City of New York Office of the Comptroller Certified Payroll Report.

Adding to the complexity is the fact that unions typically have complex collective bargaining agreements (CBAs) that outline intricate provisions on wage rates, fringe benefits and work conditions. As a result, the rules and regulations surrounding union payrolls are constantly changing. Maintaining thorough and organized record-keeping is key for compliance checks, audits and resolving disputes.

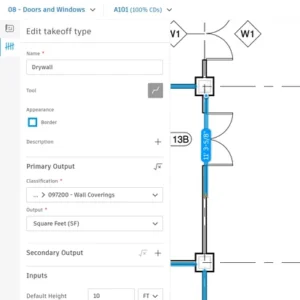

The good news is that there are ways to minimize the stress of union payroll processing. Investing in a construction-specific HCM software that can handle the unique payroll calculations and reporting required for union workers can save you time and money while improving compliance.

With a system that can process union payrolls, you’ll be able to accurately track and calculate hours worked for union employees. This is important because even minor mistakes can have costly consequences. For example, if you set aside the wrong amount for union dues or fail to account for billable vs non-billable overtime, you could be facing expensive fines from the labor union.

Accurate Calculations

Payroll processing is complex, and adding union requirements to the mix can make it seem insurmountable. Companies and contractors who work with unions must keep track of wages, clocked hours, insurance, benefits packages, healthcare and vacation time. They also need to take into account additional deductions and fringes their home union might require, such as political action contributions and pensions. Additionally, they must understand varying rates, multi-tiered pay rates and deduction requirements based on craft, seniority and job classifications.

Managing all of this is challenging without accurate, efficient and up-to-date software. Streamlined and automated processes help reduce the risk of errors that can lead to costly penalties, disputes or non-compliance with regulations. Integrated software can also provide compliance assurance by accurately determining wage rates based on job classifications and prevailing wage determinations, simplifying certified payroll reporting for government projects.

In addition, it’s important to document agreements, communications and disputes in writing. This helps protect you and your business in case of future legal disputes or audits, and can prove invaluable for resolving issues with unions.

Timely Payments

When it comes to calculating and processing payroll for union workers, there are a lot of moving parts. These additional calculations include setting aside a portion of the paycheck for dues, making various deduction calculations and managing fringe benefits and other employee compensation items not included on a worker’s pay stub. Having the right construction accounting system in place can help you streamline these processes to ensure that accurate payments are made to your workers on time and that you meet all compliance requirements for federal, state and city projects.

Achieving compliance with CBAs and other labor laws is essential for contractors handling union payroll. This can be stressful and challenging, particularly when multiple projects are under different CBAs with varying rules. Thorough record-keeping is critical to avoid disputes or penalties for violations.

In addition, a construction accounting system that supports union payroll can help you make sure you have the data needed to produce certified payroll reports when required for government projects. These reports must detail a full breakdown of wages, benefits and deductions. This can be difficult to achieve without an integrated solution that understands the complexities of multiple local unions and their corresponding wage rates, deductions and other rules. It’s also important to be able to track and calculate overtime, ensuring that your workforce is paid for the hours they work and that you’re not overpaying employees.

Compliance

If you’re not familiar with the nuances of processing payroll for union workers, it can feel like an insurmountable task. Even the slightest mistake can have serious consequences, including financial penalties from the union and legal issues for your organization.

To ensure compliance with union payroll requirements, it’s critical to have a system that accurately records all employee information, including the full name and job classification of each worker. It’s also necessary to verify that wage rates reflect the terms of the relevant CBA or prevailing wage determination. In addition, the system should calculate and record all required deductions from union worker earnings. This includes mandatory withholdings for federal and state taxes, as well as contributions to health and welfare funds, pension funds and other fringe benefits.

It’s also crucial to regularly update your policies and procedures to align with new labor laws, CBAs and prevailing wage rates. Integrated software can help you do this quickly and easily, with minimal disruption to your workforce.

With Criterion, you can simplify your processes, eliminate the stress of compliance and keep your team on-track for zero payment delays. Book a demo today to see how our HCM solution can work for you. You’ll be glad you did.